Paul B Insurance for Dummies

Wiki Article

The smart Trick of Paul B Insurance That Nobody is Talking About

Table of ContentsNot known Incorrect Statements About Paul B Insurance Not known Factual Statements About Paul B Insurance 3 Easy Facts About Paul B Insurance DescribedThe Definitive Guide to Paul B Insurance7 Easy Facts About Paul B Insurance ShownPaul B Insurance Can Be Fun For EveryoneNot known Facts About Paul B Insurance

Check in with the various other vehicles entailed and also ensure no person has injuries. Call 911 if any person requires medical support. You need to also call the local cops to make an accident record. The insurer will certainly evaluate this report very closely when examining your case. Take notes that cover all the information of the mishap.

The moment the crash happened. The names as well as get in touch with information of witnesses to the accident. The climate as well as roadway conditions at the time of the mishap. The name and also badge variety of the policeman who gets to the crash scene. Sue with your insurer immediately after the mishap.

Go to the accident scene. Analyze healthcare facility bills, medical records, as well as proof of shed wages connected with the mishap with your approval.

The 6-Second Trick For Paul B Insurance

Establish mistake in the accident. Go after the other chauffeur's insurance firm if he or she was at mistake.Understanding exactly how car insurance functions need to be a concern for any new chauffeur. Talk to your insurance provider if you already have coverage however desire to discover even more regarding your plan. A representative can help you choose car insurance policy that secures your personal assets from loss in an auto crash.

As a result, term life insurance policy tends to be extra affordable than long-term life insurance policy, with a fixed price that lasts for the whole term. As the initial term attracts to a close, you might have 3 choices for ongoing coverage: Allow the plan end and also replace it with a brand-new plan Renew the plan for another term at a modified price Convert your term life insurance policy to whole life insurance policy Not all term life insurance policy plans are renewable or convertible.

Some Ideas on Paul B Insurance You Need To Know

:max_bytes(150000):strip_icc()/terms_i_insurance_FINAL_-3556393b3bbf483e9bc8ad9b707641e4.jpg)

The payment mosts likely to the loan provider instead of any type of survivors to settle the remaining equilibrium. Due to the fact that debt life insurance is so targeted, it is much easier to get approved for than other alternatives. As long as the insurance policy holder pays the premiums, permanent life insurance policy never ever expires. Because it covers the insured's entire life, premiums are greater than a term life insurance policy policy.

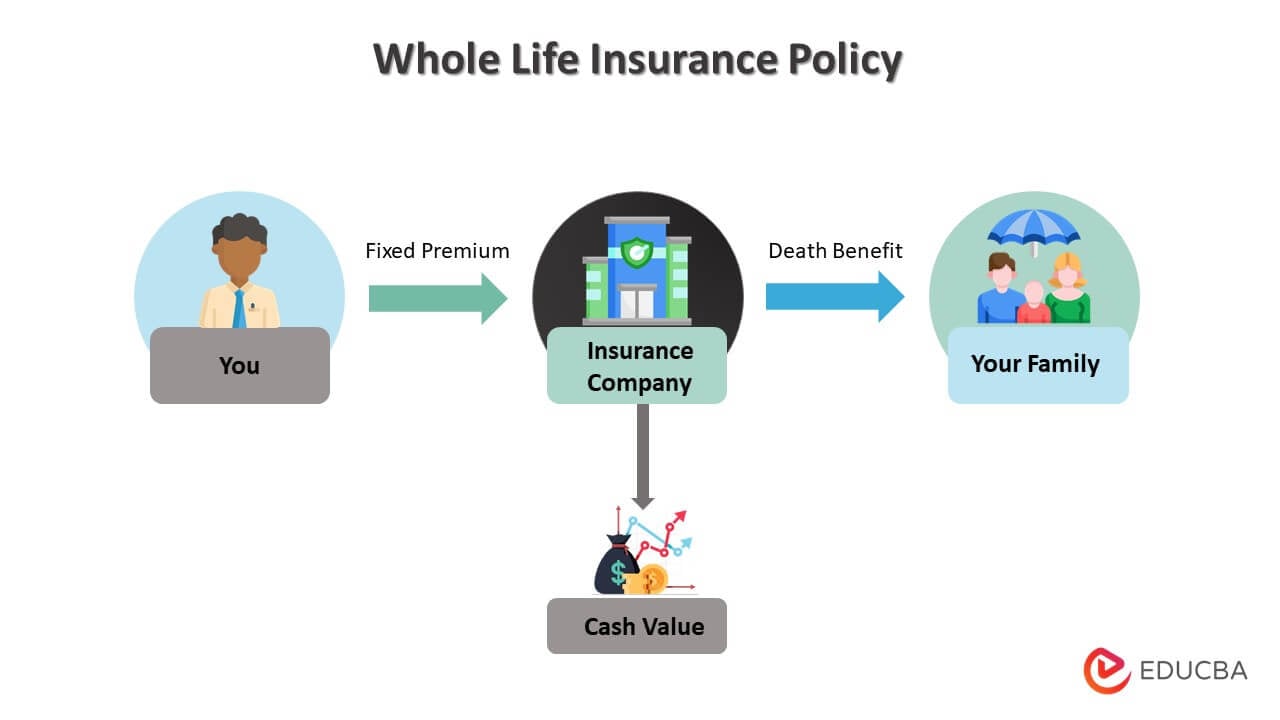

Learn more regarding the the original source various types of permanent life insurance policy below. is what most individuals think about when they think about permanent life insurance. It pays out anytime the policyholder dies as well as has a money value that enhances in time, comparable to a cost savings account. While the insurance policy holder is still to life, she or check here he can make use of the policy's cash worth.

The Definitive Guide for Paul B Insurance

The crucial distinction is the policyholder's capability to invest the policy's cash money value. Throughout all this, the insurance policy holder must preserve a high adequate money worth to cover any kind of policy fees.On the flip side, the earnings from a high-return financial investment could cover some or every one of the premium costs. One more benefit is that, unlike with many policies, the cash money value of a variable plan can be included to the fatality benefit. Last cost life insurance policy, likewise called burial or funeral insurance policy, is suggested to cover bills that will certainly be credited the insurance policy holder's family or estate.

It is an especially attractive choice if one event has health problems that make a private plan expensive. Nevertheless, it is less typical than other kinds of long-term life insurance policy.

Some Known Details About Paul B Insurance

A couple of things you ought to recognize about travel insurance policy: Benefits differ by strategy. Travel insurance can't cover every feasible situation.Without traveling insurance coverage, you would certainly lose the cash you invested on your trip., which indicates you can be repaid for your pre paid, nonrefundable trip expenses.

The Ultimate Guide To Paul B Insurance

You can contrast the costs as well as benefits of each. It consists of journey cancellation, trip disruption as well as journey delay benefits.

This budget friendly strategy consists of emergency clinical and emergency transportation benefits, along with various other post-departure benefits, however trip cancellation/interruption. If you want the peace of mind of bring substantial traveling the original source insurance policy advantages, the most effective fit may be the One, Journey Prime Plan. This plan additionally covers kids 17 as well as under completely free when traveling with a parent or grandparent.

It offers you budget-friendly protection for a full year of traveling, including advantages for journey termination and disruption; emergency situation healthcare; lost/stolen or postponed baggage; as well as Rental Auto Theft & Damage defense (available to citizens of the majority of states). The finest time to get travel insurance policy is right away after you have actually finished your travel arrangements.

Examine This Report about Paul B Insurance

You should acquire your plan within 14 days of making your initial trip deposit in order to be qualified for the pre-existing clinical problem benefit (not readily available on all plans). If you're not entirely pleased with your strategy, you have 15 days (or a lot more, depending upon your state of home) to request a reimbursement, supplied you haven't started your journey or launched a case.Strategies may supply some added benefits that Original Medicare doesn't cover like vision, hearing, and oral services. You join a strategy used by Medicare-approved private firms that adhere to policies set by Medicare. Each plan can have various regulations for exactly how you get solutions, like requiring recommendations to see a specialist.

Report this wiki page